Bulls and bears are more emotionally invested in a congestion zone the longer prices are in it.

Similar to a battlefield with explosion craters, a congested area affected by multiple trends has defenders who have lots of cover and will likely slow down any invading force.

- It provides support as prices move toward that area from above.

- It serves as resistance when prices rally into it from below.

These roles can be reversed in a congested location, which can act as either support or resistance.

Three things affect how strong certain zones are: their length, height, and amount of activity that has occurred there.

These elements can be thought of as the breadth, depth, and length of a congestion zone.

A support or resistance area’s strength increases with length, whether measured in time or in the number of blows it withstood.

Like fine wine, support and resistance get better with age.

A 2-month trading range gives people time to adjust and produces intermediate support or resistance, while a 2-year range establishes itself as a benchmark of value and offers significant support or resistance. A 2-week trading range simply offers minor support or resistance.

Support and resistance levels gradually weaken as they become very old.

Losers continue to leave the markets, being replaced by newcomers who lack the same emotional attachment to extremely low price levels.

People who recently lost money are well aware of what transpired. They are possibly still active in the market, suffering regret and trying to avenge themselves.

People who made poor decisions in the past may no longer be in that market, so their memories are less important.

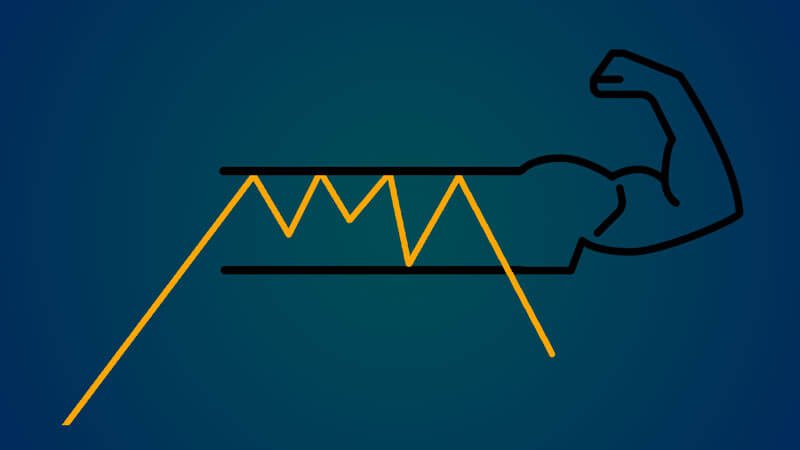

Resistance Turns into Support

Every time that area is hit, support and resistance become stronger.

Traders frequently wager on a price reversal the next time prices hit a particular level when they observe that prices have reversed at that level.

The strength of the support and resistance zone increases with height. Similar to a high fence enclosing a property, a towering congestion zone.

A congestion zone offers only little support or resistance if its height is equal to 1% of the current market value.

A congestion zone that is three percent tall or more offers intermediate support or resistance, and one that is seven percent tall or more can stifle a big trend. A support and resistance zone is more powerful the more trade occurs there.

Trading activity is demonstrated by high volume, which is a strong emotional commitment.

Low traffic indicates that traders are not interested in making a transaction at that time.